可视化股票市场结构简介

本示例采用了几种无监督学习技术,以从历史报价的变化中提取股票市场结构。

我们使用的数量是报价的每日变化:关联报价在一天中往往会一起波动。

下面是数据分析方法:

学习图结构

我们使用稀疏逆协方差估计来查找哪些报价跟其他报价条件相关。具体来说,稀疏逆协方差给出了一个图,即一个连接列表。在图中对于每个符号(Symbol)来说,它所连接的其他符号可以用来解释其波动。

聚类

我们使用聚类将表现相似的报价分组在一起。在scikit-learn中可用的各种聚类技术中,我们选用亲和力传播(Affinity Propagation)模型,因为它不强制要求大小相同的簇,并且可以从数据中自动选择簇数。

请注意,这给了我们与图不同的表示,因为图反映了变量之间的条件关系,而聚类反映了边际属性:聚类在一起的变量对整个股票市场具有相似的影响。

嵌入2D空间

出于可视化目的,我们需要在2D画布上布置不同的符号(Symbol)。为此,我们使用流形学习(Manifold learning )技术获取2D嵌入(Embedding)。

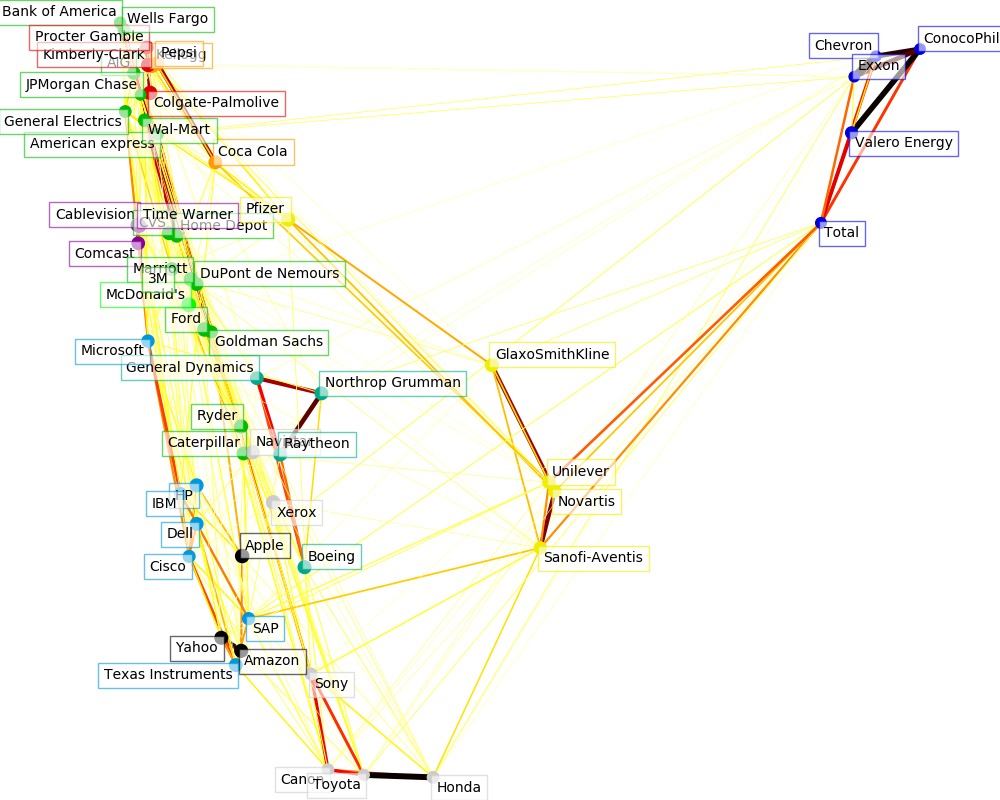

可视化

将3个模型的输出组合成2D图,其中节点表示股票符号(Symbol):

- 聚类标记,用于定义节点的颜色

- 稀疏协方差模型,用于显示边的强度

- 2D嵌入,用于定位节点

此示例包含大量可视化相关的代码,挑战之一是如何放置标签以最大程度地减少重叠。为此,我们使用基于每个轴上最近邻居的方向的启发式方法。

代码实现[Python]

# -*- coding: utf-8 -*-

# Author: Gael Varoquaux gael.varoquaux@normalesup.org

# License: BSD 3 clause

import sys

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.collections import LineCollection

import pandas as pd

from sklearn import cluster, covariance, manifold

print(__doc__)

# #############################################################################

# 从Internet上获取股票数据

# The data is from 2003 - 2008. This is reasonably calm: (not too long ago so

# that we get high-tech firms, and before the 2008 crash). This kind of

# historical data can be obtained for from APIs like the quandl.com and

# alphavantage.co ones.

symbol_dict = {

'TOT': 'Total',

'XOM': 'Exxon',

'CVX': 'Chevron',

'COP': 'ConocoPhillips',

'VLO': 'Valero Energy',

'MSFT': 'Microsoft',

'IBM': 'IBM',

'TWX': 'Time Warner',

'CMCSA': 'Comcast',

'CVC': 'Cablevision',

'YHOO': 'Yahoo',

'DELL': 'Dell',

'HPQ': 'HP',

'AMZN': 'Amazon',

'TM': 'Toyota',

'CAJ': 'Canon',

'SNE': 'Sony',

'F': 'Ford',

'HMC': 'Honda',

'NAV': 'Navistar',

'NOC': 'Northrop Grumman',

'BA': 'Boeing',

'KO': 'Coca Cola',

'MMM': '3M',

'MCD': 'McDonald\'s',

'PEP': 'Pepsi',

'K': 'Kellogg',

'UN': 'Unilever',

'MAR': 'Marriott',

'PG': 'Procter Gamble',

'CL': 'Colgate-Palmolive',

'GE': 'General Electrics',

'WFC': 'Wells Fargo',

'JPM': 'JPMorgan Chase',

'AIG': 'AIG',

'AXP': 'American express',

'BAC': 'Bank of America',

'GS': 'Goldman Sachs',

'AAPL': 'Apple',

'SAP': 'SAP',

'CSCO': 'Cisco',

'TXN': 'Texas Instruments',

'XRX': 'Xerox',

'WMT': 'Wal-Mart',

'HD': 'Home Depot',

'GSK': 'GlaxoSmithKline',

'PFE': 'Pfizer',

'SNY': 'Sanofi-Aventis',

'NVS': 'Novartis',

'KMB': 'Kimberly-Clark',

'R': 'Ryder',

'GD': 'General Dynamics',

'RTN': 'Raytheon',

'CVS': 'CVS',

'CAT': 'Caterpillar',

'DD': 'DuPont de Nemours'}

symbols, names = np.array(sorted(symbol_dict.items())).T

quotes = []

for symbol in symbols:

print('Fetching quote history for %r' % symbol, file=sys.stderr)

url = ('https://raw.githubusercontent.com/scikit-learn/examples-data/'

'master/financial-data/{}.csv')

quotes.append(pd.read_csv(url.format(symbol)))

close_prices = np.vstack([q['close'] for q in quotes])

open_prices = np.vstack([q['open'] for q in quotes])

# The daily variations of the quotes are what carry most information

variation = close_prices - open_prices

# #############################################################################

# 从相关性学习图结构

edge_model = covariance.GraphicalLassoCV(cv=5)

# standardize the time series: using correlations rather than covariance

# is more efficient for structure recovery

X = variation.copy().T

X /= X.std(axis=0)

edge_model.fit(X)

# #############################################################################

# 亲和力传播聚类

_, labels = cluster.affinity_propagation(edge_model.covariance_)

n_labels = labels.max()

for i in range(n_labels + 1):

print('Cluster %i: %s' % ((i + 1), ', '.join(names[labels == i])))

# #############################################################################

# 计算低维embedding: find the best position of

# the nodes (the stocks) on a 2D plane

# We use a dense eigen_solver to achieve reproducibility (arpack is

# initiated with random vectors that we don't control). In addition, we

# use a large number of neighbors to capture the large-scale structure.

node_position_model = manifold.LocallyLinearEmbedding(

n_components=2, eigen_solver='dense', n_neighbors=6)

embedding = node_position_model.fit_transform(X.T).T

# #############################################################################

# 可视化

plt.figure(1, facecolor='w', figsize=(10, 8))

plt.clf()

ax = plt.axes([0., 0., 1., 1.])

plt.axis('off')

# Display a graph of the partial correlations

partial_correlations = edge_model.precision_.copy()

d = 1 / np.sqrt(np.diag(partial_correlations))

partial_correlations *= d

partial_correlations *= d[:, np.newaxis]

non_zero = (np.abs(np.triu(partial_correlations, k=1)) > 0.02)

# Plot the nodes using the coordinates of our embedding

plt.scatter(embedding[0], embedding[1], s=100 * d ** 2, c=labels,

cmap=plt.cm.nipy_spectral)

# Plot the edges

start_idx, end_idx = np.where(non_zero)

# a sequence of (*line0*, *line1*, *line2*), where::

# linen = (x0, y0), (x1, y1), ... (xm, ym)

segments = [[embedding[:, start], embedding[:, stop]]

for start, stop in zip(start_idx, end_idx)]

values = np.abs(partial_correlations[non_zero])

lc = LineCollection(segments,

zorder=0, cmap=plt.cm.hot_r,

norm=plt.Normalize(0, .7 * values.max()))

lc.set_array(values)

lc.set_linewidths(15 * values)

ax.add_collection(lc)

# Add a label to each node. The challenge here is that we want to

# position the labels to avoid overlap with other labels

for index, (name, label, (x, y)) in enumerate(

zip(names, labels, embedding.T)):

dx = x - embedding[0]

dx[index] = 1

dy = y - embedding[1]

dy[index] = 1

this_dx = dx[np.argmin(np.abs(dy))]

this_dy = dy[np.argmin(np.abs(dx))]

if this_dx > 0:

horizontalalignment = 'left'

x = x + .002

else:

horizontalalignment = 'right'

x = x - .002

if this_dy > 0:

verticalalignment = 'bottom'

y = y + .002

else:

verticalalignment = 'top'

y = y - .002

plt.text(x, y, name, size=10,

horizontalalignment=horizontalalignment,

verticalalignment=verticalalignment,

bbox=dict(facecolor='w',

edgecolor=plt.cm.nipy_spectral(label / float(n_labels)),

alpha=.6))

plt.xlim(embedding[0].min() - .15 * embedding[0].ptp(),

embedding[0].max() + .10 * embedding[0].ptp(),)

plt.ylim(embedding[1].min() - .03 * embedding[1].ptp(),

embedding[1].max() + .03 * embedding[1].ptp())

plt.show()

代码执行

代码运行时间大约:0分4.857秒。

运行代码输出的文本内容如下:

Cluster 1: Apple, Amazon, Yahoo Cluster 2: Comcast, Cablevision, Time Warner Cluster 3: ConocoPhillips, Chevron, Total, Valero Energy, Exxon Cluster 4: Cisco, Dell, HP, IBM, Microsoft, SAP, Texas Instruments Cluster 5: Boeing, General Dynamics, Northrop Grumman, Raytheon Cluster 6: AIG, American express, Bank of America, Caterpillar, CVS, DuPont de Nemours, Ford, General Electrics, Goldman Sachs, Home Depot, JPMorgan Chase, Marriott, 3M, Ryder, Wells Fargo, Wal-Mart Cluster 7: McDonald's Cluster 8: GlaxoSmithKline, Novartis, Pfizer, Sanofi-Aventis, Unilever Cluster 9: Kellogg, Coca Cola, Pepsi Cluster 10: Colgate-Palmolive, Kimberly-Clark, Procter Gamble Cluster 11: Canon, Honda, Navistar, Sony, Toyota, Xerox

运行代码输出的图片内容如下:

源码下载

- Python版源码文件: plot_stock_market.py

- Jupyter Notebook版源码文件: plot_stock_market.ipynb